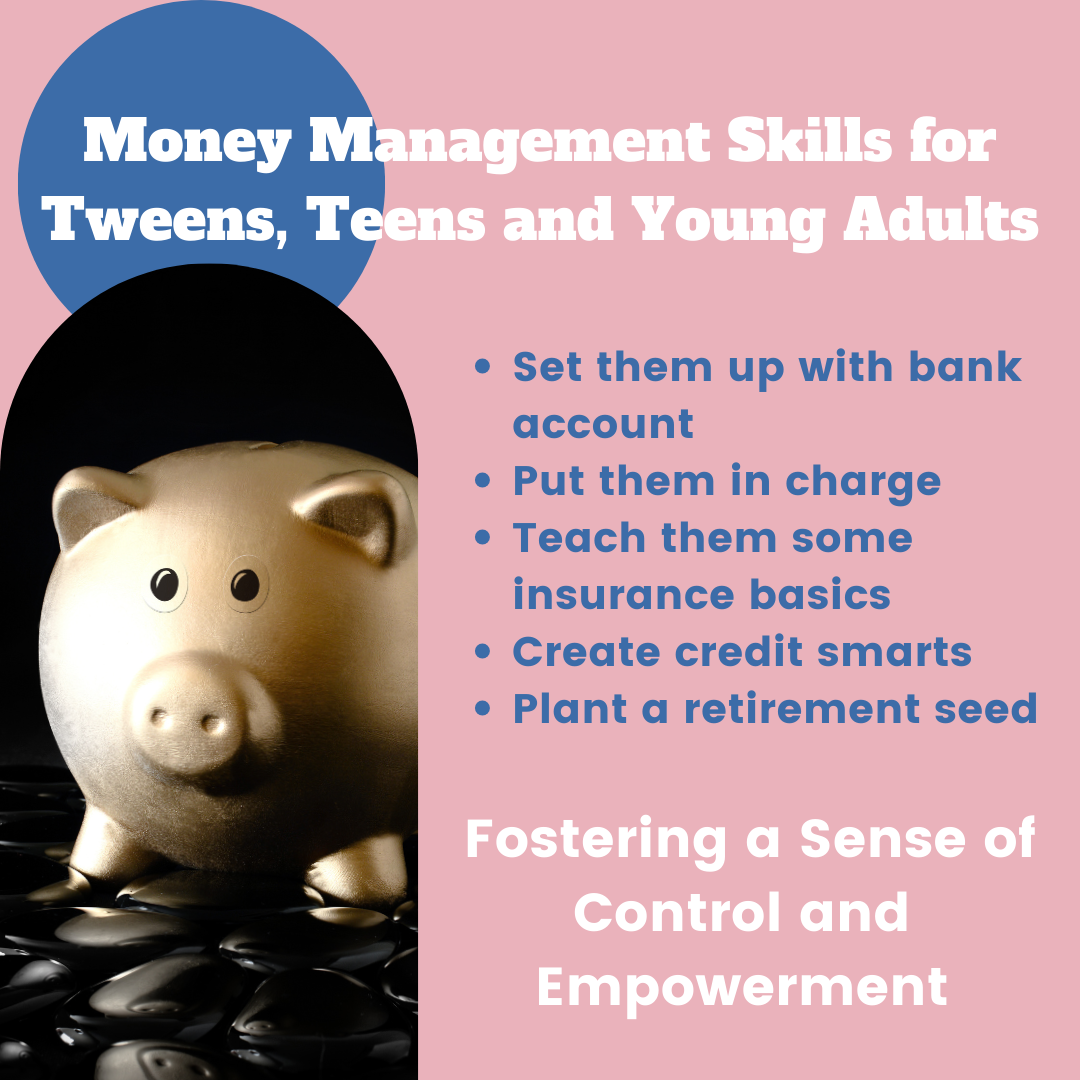

Money Management Skills for Tweens, Teens and Young Adults: Fostering a Sense of Control and Empowerment

In an age where our internet generation kids are growing up in increasingly chaotic times confronted with issues of managing social media, navigating a volatile political landscape, and the lingering effects of the pandemic, it is no surprise that they are struggling to maintain mental fitness. A survey from Deloitte consulting company found that financial uncertainty was at the top of their list as a stressor. Would you be surprised to know that money management skills for tweens and teens relates to positive mental fitness by reducing anxiety and creating a sense of control and empowerment? Unfortunately, according to a recent study published in parents.com, 69% of Internet generation kids, or those born between the 1990s and the early 2000s, do not comprehend properly how much they should spend relative to how much they should save for long-term goals. Money management is often an over-looked foundational skill just as important as sleep hygiene, nutrition, physical activity, and time management for staying organized and feeling in control.

Here are some tips from the Parents Network for helping your teen learn to manage money:

- Set them up with bank accounts: Open a checking account for daily spending and a savings account for future goals.

- Put them in charge: You may or may not have heard of the 50/30/20 rule. It is a good way to help teens start thinking about making a budget that works for their current life situation. Fifty percent goes to essentials, 30% is for personal spending, and 20% goes towards savings.

- Teach them some insurance basics: If your teen is close to driving age, explain that the purpose of insurance is to cover big costs that would otherwise be hard to pay on their own.

- Create credit smarts: As scary as it may seem, giving your child a credit card is an opportunity to teach them about the difference between credit and cash and build a credit history.

- Plant a retirement seed: Let them know that retirement is the biggest expense they will ever have. If they are employed and are earning an income, think about opening an individual retirement account (IRA).

Check out the link below from the Public Library Association for resources on teaching your child to achieve financial literacy for success as they mature into adulthood.

https://www.ala.org/pla/resources/tools/youth-services/teen-financial-literacy

Schedule a Free Consultation

Call us to schedule your free consultation.